How Real Estate Investors Can Profit From Specialized Industrial Nearshoring

The world of manufacturing is undergoing a structural realignment. Global trade disruptions, tariff policies, and rising geopolitical tensions have exposed the vulnerabilities of far-flung, just-in-time supply chains. But instead of bringing all production back home, many manufacturers are pursuing a more targeted strategy: nearshoring specialized manufacturing.

This is not about shifting textile factories or generic assembly plants. It’s about relocating high-value, high-complexity production closer to end markets. And it’s creating a significant opportunity for real estate investors, especially those holding or developing the right type of industrial space in the Sunbelt, Midwest, and rust belt hubs like Chicago.

This is why experts like Richard Barnett believe specialized manufacturing is the most viable nearshoring candidate, and what types of properties are best positioned to benefit from it.

Why Specialized Manufacturing is the Prime Nearshoring Candidate

1. It’s About Precision, Not Scale

Unlike commoditized manufacturing, specialized manufacturing involves high-mix, low-volume production. These facilities produce things like:

-

Aerospace components

-

Electric vehicle parts

-

Medical devices

-

Industrial automation systems

-

Semiconductors or chip packaging modules

This type of production favors proximity to engineering teams, customers, and supply chain partners. It’s less labor-intensive and more capital-intensive, making labor-cost arbitrage far less relevant. Instead, the priorities shift to supply chain speed, IP protection, and product quality.

2. Proximity and Responsiveness Trump Lowest Cost

What these firms need is:

-

Fast access to U.S. end markets

-

Skilled labor or technical training ecosystems

-

Stable infrastructure and regulatory alignment

That’s why you’re seeing more expansions in Monterrey, Northern Mexico, and U.S. interior markets like Chicago, Columbus, Kansas City, and Greenville-Spartanburg. Specialized manufacturers want to be near logistics hubs, airports, and intermodal rail, not just cheap land.

What Real Estate Investors Should Focus On

Investors and developers should be asking: What types of assets and locations will these specialized manufacturers lease or buy? Here’s the breakdown by region and property type.

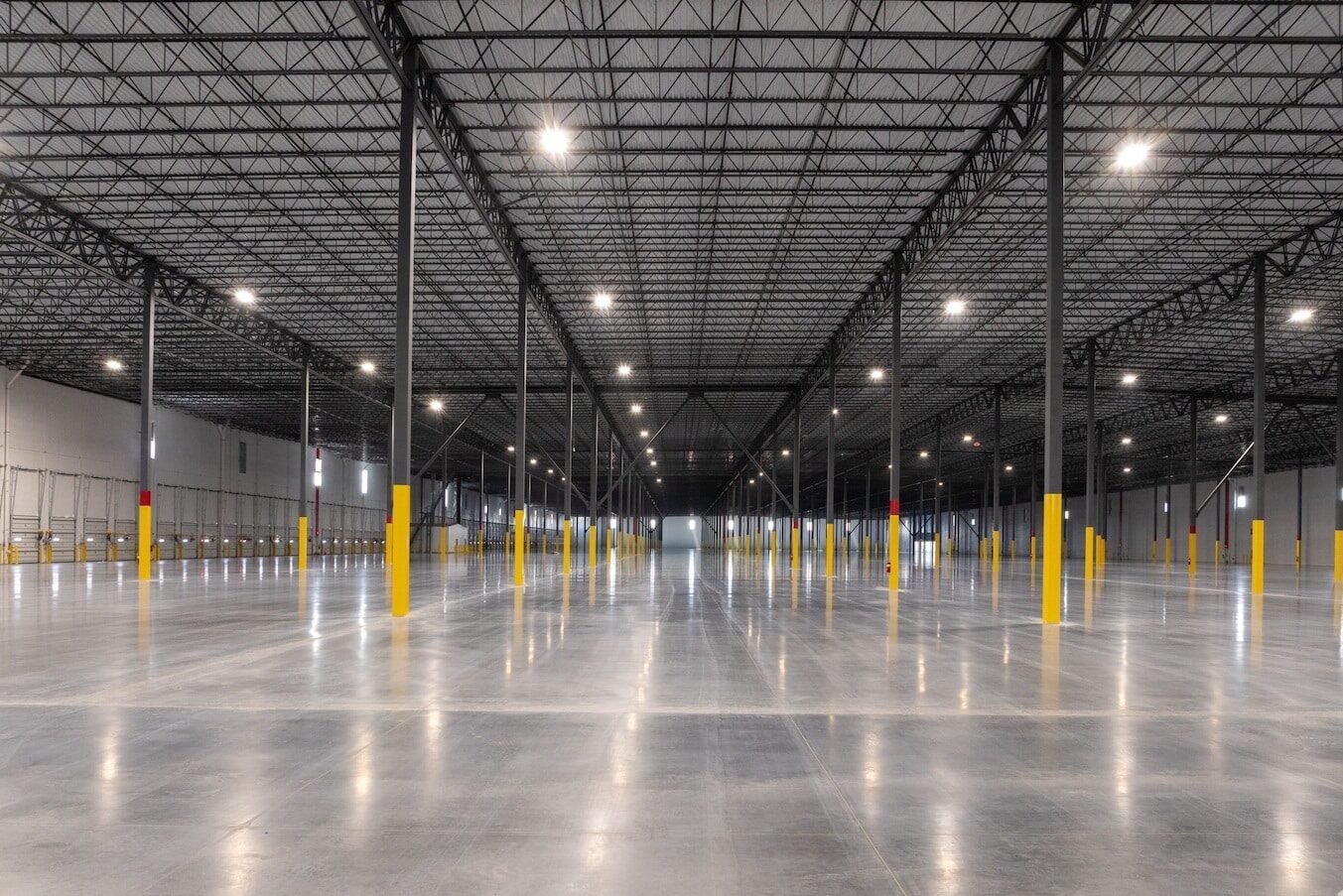

Modern Mid-Sized Industrial Facilities (Less Than 100,000 SF)

-

Why: This is the sweet spot for specialized users. It is not too big like e-commerce bulk, but it does not have flex space.

-

What Tenants Want:

-

Clear heights of 24’–32′

-

High power capacity

-

HVAC-ready shell or conditioned space

-

Mezzanine or office buildout

-

Dock and drive-in options

-

-

Where to Focus:

-

Chicagoland’s I-55, I-80, Elk Grove Village, and O’Hare corridors

-

Cincinnati-Dayton, St. Louis, Milwaukee suburbs

-

Central Texas, Phoenix, Huntsville, Greenville, SC

-

In Chicagoland specifically, older Class B/C assets with structural integrity and zoning for light industrial use are being rehabbed into clean-tech or assembly-ready sites. Suburbs like Elk Grove Village, Carol Stream, and Naperville offer a strong mix of infrastructure, workforce, and highway access.

Small-Scale Build-to-Suit or Light Manufacturing Campuses

-

Why: Many specialized users have custom workflow or equipment needs.

-

What Tenants Want:

-

5–20 acre parcels

-

Room for phased expansion

-

Utilities to spec (especially 3-phase and high-amperage electrical)

-

Zoning for light/heavy industrial

-

Proximity to suppliers, ports, or R&D hubs

-

-

Where to Focus:

-

Periphery of major metros like Indianapolis, Columbus, and San Antonio

-

Inland logistics zones (e.g. Joliet-Elwood, WI’s I-94 corridor)

-

Rail-served secondary markets with strong power and incentives

-

Municipalities compete to attract these tenants, so sites near enterprise zones or manufacturing incentives are especially valuable.

Flex Industrial / R&D-Integrated Facilities

-

Why: Specialized manufacturers often combine light assembly, prototyping, and R&D in the same footprint.

-

What Tenants Want:

-

20,000–60,000 SF with 30–40% office or lab space

-

Access to engineering talent or academic institutions

-

Business park settings with strong image and amenities

-

-

Where to Focus:

-

Lake County, IL, DuPage County, North Austin

-

Ann Arbor, Research Triangle, Tempe-Mesa Gateway area

-

Libertyville or Lincolnshire for firms serving suburban Chicago medtech clusters

-

This area is where older suburban office/flex products can be repositioned as “hybrid innovation space” for precision manufacturers and OEM suppliers.

Facilities With Heavy Power or Utility Infrastructure

-

Why: High-tech manufacturers increasingly need major power loads, especially in the battery, medical device, or microchip packaging sectors.

-

What Tenants Want:

-

Sites with existing 2,000+ amps of power

-

Utility redundancy (dual feeds, backup gen)

-

High-speed fiber

-

-

Where to Focus:

-

Legacy manufacturing towns (Rockford, South Bend, Peoria) with existing utility capacity

-

Midwestern towns near data centers and EV investments

-

Old steel towns with industrial zoning and brownfield sites ready for rehab

-

If you have an asset with embedded infrastructure, even if it’s cosmetically dated—you may be holding a diamond in the rough for today’s specialized tenant.

What Makes the Midwest and Chicagoland Especially Attractive

Chicagoland is a logistics nerve center—with six Class I railroads, O’Hare International Airport, and access to I-55, I-80, I-88, and I-90. This makes Chicago a prime target for nearshoring tenants. But unlike e-commerce users who want 500,000+ SF boxes, specialized manufacturers want smaller, more functional spaces near their workforce and suppliers.

Key local advantages:

-

Diverse Labor Force: From engineering grads to CNC technicians, Chicagoland offers the full talent stack.

-

Aging Inventory = Opportunity: Many older properties with heavy power and industrial zoning can be repositioned for today’s users.

-

Proximity to End Markets: Specialized manufacturers serve Tier 1 suppliers, medical networks, or aerospace hubs—many within a few hours’ drive.

Markets like Elk Grove Village, Bensenville, Addison, and Waukegan have proven especially sticky for precision manufacturing users. Lake County continues to see demand from medtech and clean energy manufacturing tenants, while South Suburban locations are attracting companies looking for scale and incentives.

Investor Takeaways

If you’re a real estate investor looking to capitalize on nearshoring demand from specialized manufacturers, here’s how to position:

-

Prioritize assets under 100,000 SF with flexibility for light production and office/lab integration

-

Focus on infill submarkets near labor and transit infrastructure

-

Target power-rich properties or sites with entitlements and utilities ready

-

Don’t overlook B/C assets—especially if the bones are solid and zoning is favorable

-

Be early in supply-constrained submarkets where new industrial isn’t being built at scale

Remember: these tenants stay longer, invest more in their spaces, and value proximity to both workforce and logistics. If you have or can develop the right kind of facility in the right location, you’re not just following a trend. You’re capturing the most durable industrial space demand in the next decade.