Demolitions and Conversions Now Outpace New Office Development for the First Time in Decades

For the first time in nearly 25 years, more office space is being taken out of the U.S. inventory than added to it. According to Bisnow, 2025 marks a historic turning point in office real estate: the volume of office demolitions and conversions is projected to exceed the volume of new construction, a stark signal that the office sector is undergoing structural transformation, not just cyclical disruption.

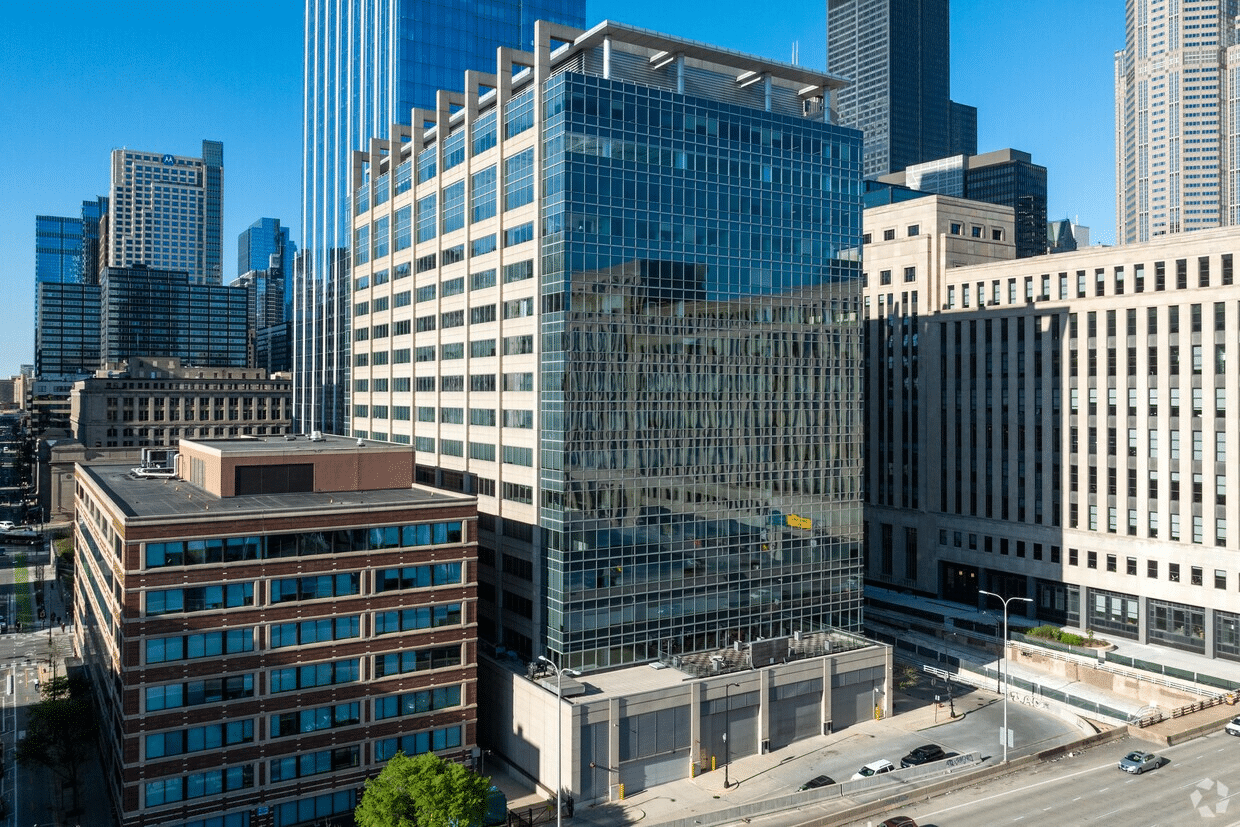

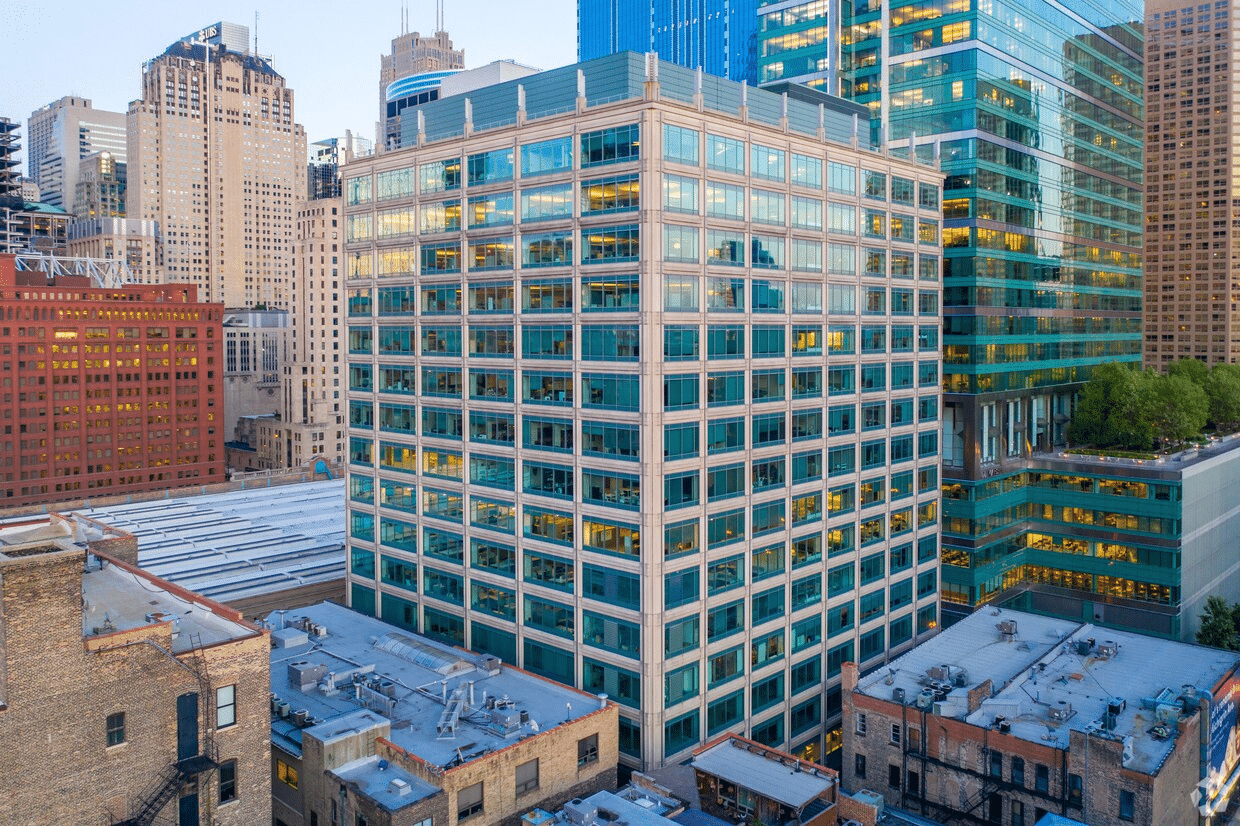

In Chicagoland, this shift is becoming visible across the skyline and in suburban markets alike.

Chicago’s Office Supply Is Shrinking—By Design

Across the country, more than 14 million square feet of office space is expected to be demolished or converted this year, outpacing new deliveries for the first time since 2000. Chicago is at the forefront of this trend. From vintage towers in the Loop to underutilized suburban campuses, property owners are rethinking the viability of obsolete buildings.

Recent Chicago examples include:

-

The planned demolition of the former AT&T campus in Hoffman Estates, a 1.6M+ sq. ft. site being repositioned for mixed-use and industrial redevelopment.

-

Continued office-to-residential conversions in the Loop, where city-backed incentives are accelerating adaptive reuse for older Class B and C assets.

This shrinking supply is helping improve fundamentals in select Class A buildings, but the overall market still faces an uphill climb.

Flight to Quality Continues—But the Middle Market Collapses

Leasing activity is showing signs of life, but only in the top-tier segment. Well-located, amenitized, and transit-oriented Class A buildings are outperforming, while commodity offices are languishing with 30%+ vacancy and little prospect for a rebound.

Downtown, landlords like Sterling Bay and Riverside are repositioning office towers with hotel-grade amenities, from fitness centers and lounges to concierge services. In the suburbs, investors are putting money into medical office, life science, and flex office conversions—all uses with stronger long-term demand than traditional cubes and corridors.

Development Pipeline Has All but Dried Up

Perhaps the most telling indicator of market health: new office starts in Chicago are at their lowest level in over a decade, and no major speculative towers are currently under construction. Capital for office development has become scarce, with lenders and equity partners favoring industrial, multifamily, and data center investments instead.

While this lack of new supply may eventually help stabilize vacancies, it also reflects the deep uncertainty surrounding future office demand, workplace trends, and tenant preferences.

Investor Sentiment Turns Toward Redevelopment, Not Leasing

Office buildings are no longer simply income-generating assets—they are redevelopment puzzles. Increasingly, investors are underwriting office acquisitions with demolition or conversion as the endgame, especially for older, energy-inefficient buildings with persistent vacancy.

This mindset shift is reshaping pricing expectations. Many buildings once trading at $200–300 per square foot are now being sold for land value or significantly discounted, assuming the buyer will gut, convert, or raze the property.

Chicagoland Outlook: Three Takeaways

-

Supply Contraction Is the New Norm

With Class B and C buildings becoming economically obsolete, expect more demolitions and residential or life science conversions, especially in the Loop, River North, and aging suburban office parks. -

Tenants Hold the Cards—But Only for the Right Product

Trophy buildings with access to talent, transit, and lifestyle remain in demand. Outdated offices without a compelling story are being bypassed altogether. -

Redevelopment Will Define Value Creation

Whether it’s an industrial pivot in Hoffman Estates or a residential play in the West Loop, the real estate playbook for office assets is changing quickly.

Conclusion: Adaptation Over Absorption

The Chicagoland office market is not in recovery mode—it’s in reinvention mode. Landlords, brokers, and city planners are no longer waiting for a traditional rebound. They are recognizing that many offices are no longer viable as workplaces and must be reimagined for new uses.

We may be nearing the end of the oversupplied, underutilized office era and the beginning of a market shaped by creative redevelopment, tenant-first thinking, and selective reinvestment. If you would like more information on office space in Chicago, please contact our team of commercial real estate agents.